In the bustling digital marketplace, where transactions flash faster than lightning, there emerged a hero from the UK’s financial landscape – the Paypoint Voucher. This isn’t just any payment method; it’s a beacon of security in the tempestuous sea of online payments, especially within the thrilling world of online casinos.

Once upon a time, in the realm of online casinos, players yearned for a payment method that could shield their hard-earned money from the dragons of fraud and the spectres of complexity. They sought a treasure that was both convenient and reliable, a solution that would let them focus on the joy of the game rather than the worry of the wager.

What is a Paypoint cashout Voucher

Behold the Paypoint Voucher, a gallant solution that stands out in the crowd. Its unique advantages are the stuff of legend:

– Anonymity: Players can keep their personal details a guarded secret.

– Control: It empowers users with the ability to manage their spending with pre-set limits.

– Accessibility: Available at a network of locations, it’s as easy to find as a knight’s armour in a castle.

So, embark on your gaming adventures with the Paypoint Voucher, and let the dice roll without a second thought about the safety of your gold!

Understanding Paypoint Vouchers

Paypoint Vouchers are a versatile and secure payment solution, especially popular in the UK. They offer a convenient way for consumers to manage their finances and make payments. Here’s what makes Paypoint Vouchers stand out:

- Anonymity: Users can make payments without revealing personal financial information.

- Flexibility: Vouchers can be redeemed at over 28,000 retailers across the UK.

- Ease of Use: Issued via email, letter, or SMS, they are simple to receive and redeem.

By the Numbers of Paypoint Voucher

- £5.7 billion: Amount provided to households in Great Britain through the Energy Bills Support scheme.

- 71%: Percentage of all prepayment vouchers redeemed so far.

- 83%: Record number of prepayment metre customers claiming their support with vouchers.

Paypoint Vouchers have become a crucial tool in the UK, aiding in the distribution of government support and providing a reliable payment method for various services, including online casinos. Their widespread acceptance and user-friendly nature make them a preferred choice for many.

The Evolution of PayPoint Vouchers

PayPoint vouchers have revolutionised the UK’s payment landscape, offering a cash-based alternative for online transactions. Originating from a need for secure and accessible payment methods, PayPoint quickly expanded to over 20,000 locations across the UK, Ireland, and Romania. Embracing the digital era, these e-vouchers cater to those preferring cash payments, ensuring privacy and eliminating the need for credit cards. Despite their limitation to certain regions and inability to facilitate withdrawals, PayPoint’s growth reflects a successful adaptation to consumer needs, making online purchases instantly available without compromising personal data.

How do I get a paypoint cashout voucher

PayPoint e-vouchers offer a convenient and secure way to pay for online services with cash. They’re available at over 20,000 locations across the UK, Ireland, and Romania, making them easily accessible.

Step-by-Step Guide to Using PayPoint E-Vouchers

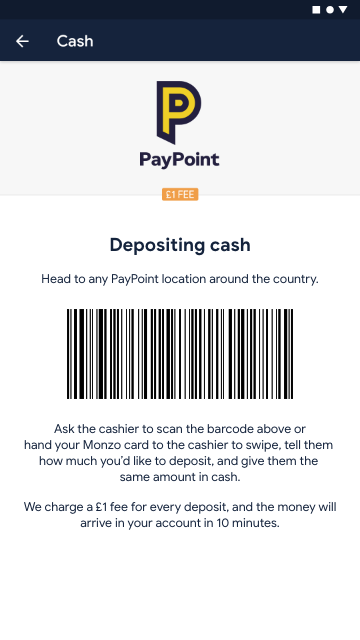

- Find a PayPoint Agent: Use the PayPoint website’s search engine to locate your nearest agent.

- Purchase the Voucher: Visit the store and buy your e-voucher with cash. A small service fee is applied.

- Deposit Funds: Log into your online casino account, select ‘PayPoint e-voucher’ as the deposit method, enter the voucher details, and process the payment for instant play.

Security and Reliability

- Privacy: Your personal and financial information remains undisclosed during the deposit process.

- No Credit Card Needed: Transactions are completed with cash, eliminating the need for a credit card.

- Instant Use: No registration or verification period is needed. Purchase the voucher and use it immediately.

PayPoint e-vouchers are a secure and user-friendly option for online payments, providing anonymity and ease of use without the need for traditional banking methods.

PayPoint E-Voucher vs. Other Payment Methods

When it comes to online transactions, especially for online casinos, the PayPoint e-voucher stands out for its unique benefits tailored for a UK audience. Let’s delve into how it compares with other payment methods.

Strengths of PayPoint E-Voucher

Security and Privacy: PayPoint e-vouchers excel in providing a secure transaction without the need to disclose personal or financial information.

Ease of Use: With no registration or verification period, PayPoint e-vouchers are incredibly user-friendly.

Cash Transactions: They allow for the use of cash in online environments, bridging the gap between physical and digital currency.

Comparison Table

| Criteria | PayPoint E-Voucher | Other Payment Methods |

| Speed | Instant | Varies |

| Cost | Small service fee | May include fees |

| Security | High | Varies |

| Ease of Use | No registration | Often requires setup |

| Availability | UK, Ireland, Romania | Global |

- Speed: PayPoint e-vouchers provide instant funds transfer, which is a significant advantage over some methods that can take days.

- Cost: While there is a small service fee, it’s often less than the fees associated with credit cards or bank transfers.

- Security: The level of security is unparalleled as it requires no sharing of personal data.

- Ease of Use: The absence of a registration process makes it simpler than many competitors.

- Availability: Although more limited geographically, it’s widely accessible where available.

In summary, PayPoint e-vouchers offer a blend of convenience, security, and speed that is hard to match. For those in the UK, Ireland, and Romania, it’s a payment method that provides peace of mind and ease, making it an excellent choice for funding online casino accounts.

Choosing an Online Casino: PayPoint Voucher Edition

When selecting an online casino that accepts PayPoint Vouchers, consider the following criteria:

- Payment Methods: Ensure that the casino supports PayPoint e-Vouchers as a deposit option.

- Security: Look for SSL encryption and robust security measures to protect your transactions.

- Game Variety: Check if the casino offers your favorite games, whether it’s slots, table games, or live dealers.

- Bonuses and Promotions: Explore welcome bonuses, free spins, and loyalty rewards.

- Customer Support: Reliable support ensures a smooth gaming experience.

Remember, the right casino is like finding a lucky charm – it enhances your gaming adventure! 🎰🍀

The Verdict

PayPoint e-vouchers offer a secure and convenient way to fund online casino accounts, especially for those who prioritise privacy and ease of use. With no need to share personal or financial details, transactions are swift and straightforward. However, the service’s limited availability and inability to process withdrawals are notable drawbacks. For UK residents, PayPoint’s widespread network makes it an accessible option, but it’s essential to plan for alternative cash-out methods. Ultimately, PayPoint e-vouchers are a solid choice for secure deposits, provided the limitations are acceptable to the user.

PROS💚

- Good customer service

- No downtime reported

- Simple setup process

- Technician problem-solving

- Versatile payment options

CONS❤️

- No online shopping use

- In-store redemption required

- Cash handling involved

- High setup costs

- Transaction fees apply

Leave a Reply